PathFinder turns wasted bank marketing spend into qualified applicants—no extra work for your team.

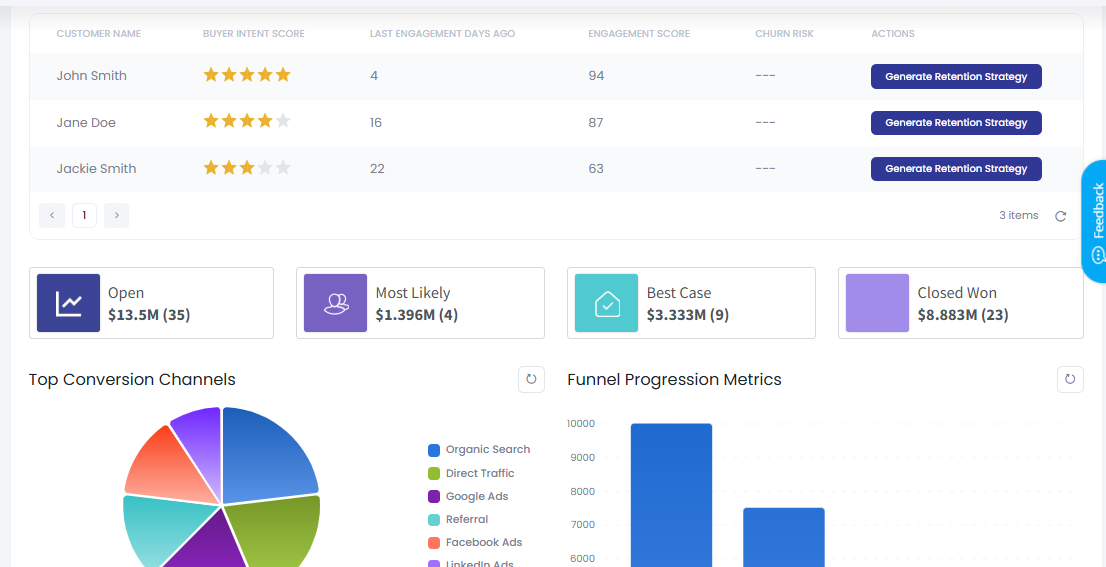

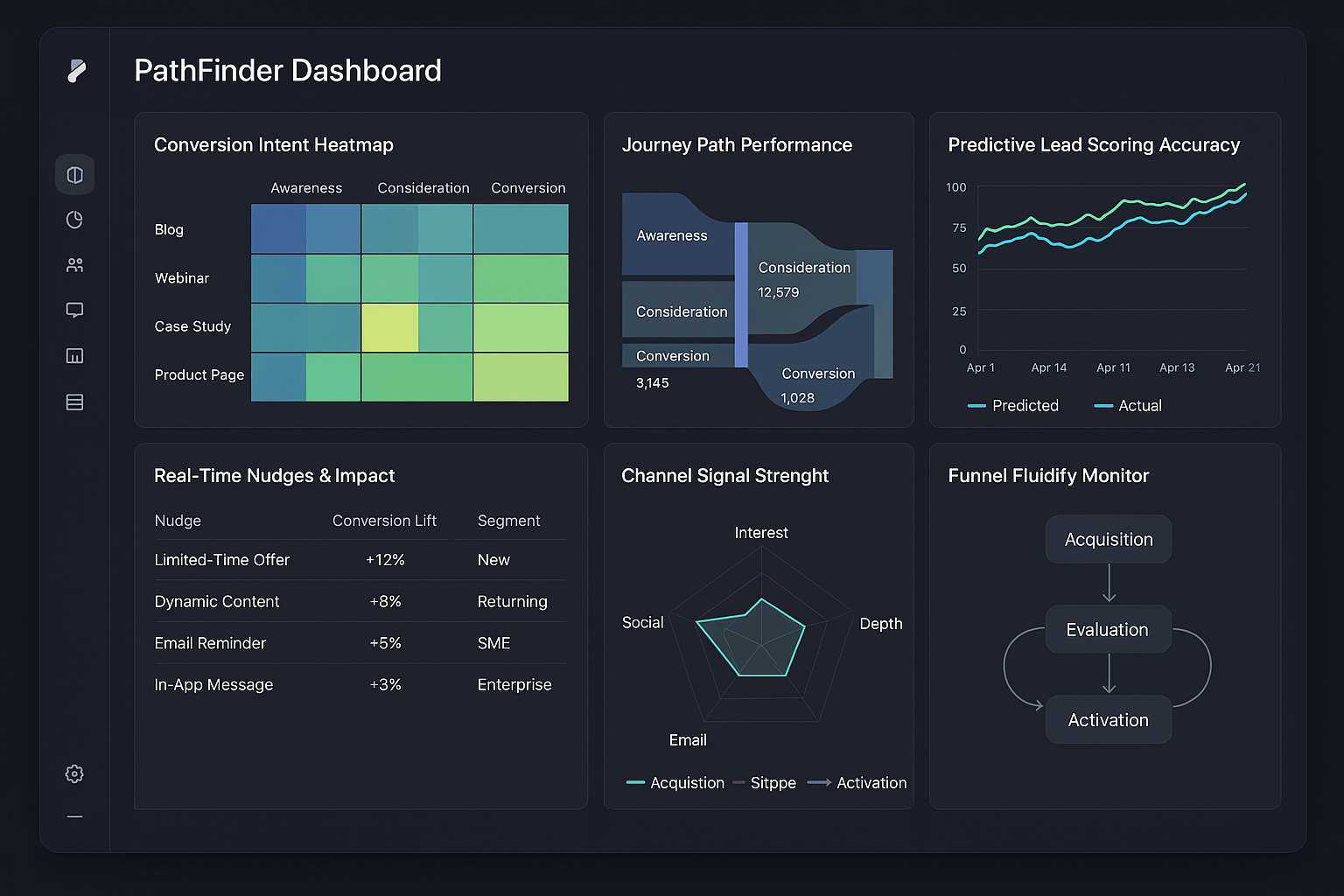

PathFinder isn’t just another optimization tool—it’s a customer intelligence engine that learns and adapts in real time. Using behavioral, contextual, and intent-based data, it personalizes conversion paths dynamically, optimizing the entire journey instead of isolated touchpoints.

Trained on conversion signals across the banking vertical

From Static Funnels to Adaptive Journeys

PathFinder shifts the focus from optimizing pages to understanding what each visitor needs to convert in the moment. By leveraging AI-powered predictive paths, it delivers tailored content, offers, and interactions—transforming traditional CRO into real-time, personalized engagement.

.png)

Your data, our intelligence - we handle the complexity

Seamless Integration

Easily connects across web, CRM, and product systems, making real-time decisioning seamless.

Behavior-Driven Personalization

Adapts interactions based on real-time user behavior, not just demographics.

Predictive Insights

Continuously learns from anonymized conversion data to refine customer journeys.

AI-Automated Optimization

Orchestrates adaptive experiences at scale without manual intervention.

What Industry Leaders Say

PathFinder offers a multilingual AI assistant that handles everything from data scanning to delivering fast results. The PathFinder team manages the entire process, allowing our loan officers to focus on what they do best—serving customers and closing deals.

"PathFinder AI has been a game-changer for us, providing real-time insights and helping us meet our CRA goals efficiently. Their data-driven approach has significantly boosted our community outreach."

"With PathFinder, we've streamlined our CRA compliance efforts while increasing engagement with low- and moderate-income borrowers. The platform's ability to track and nurture leads is unmatched."

"PathFinder’s AI-powered tools have helped us identify more CRA-qualified opportunities and seamlessly integrate them into our lending programs. It's an invaluable asset for any institution focused on community development."

"Thanks to PathFinder, we’ve not only improved our CRA performance but also deepened our relationships with underserved communities. It’s made CRA compliance easy and effective."

Why Now?

Data-Driven Precision

Companies now have the first-party behavioral data necessary for real-time intelligence.

AI-Powered Orchestration

Machine learning advancements allow for instant conversion predictions and tailored experiences.

Rising User Expectations

Customers demand seamless, hyper-personalized digital interactions—static funnels no longer work.

Redefining Conversion Optimization

Traditional methods weren’t built for today’s real-time demands. PathFinder is. See how it elevates engagement, personalizes at scale, and drives measurable results.

Clear ROI

Achieve a 10x ROI for every $1 spent on racial commitment funds by leveraging PathFinder's AI and geospatial analytics.

Fast Results

Get instant insights and actionable data to make informed lending decisions in real-time.

SITUATION

FirstBank faced significant challenges with CRA compliance, including evolving regulations, limited data, and unconscious bias in lending decisions, all while trying to avoid enforcement actions by the CFPB.

SOLUTION

By implementing PathFinder AI (previously AtlasCRA), FirstBank leveraged AI-driven insights and real-time data to address fair lending practices, improve access to financial products, and ensure CRA compliance.

IMPACT

FirstBank saw remarkable results, including a 91% increase in loan originations, a 116% increase in applications, and a 62% increase in pre-qualifications, all while improving their ability to serve LMI communities and avoid regulatory fines

Learn How PathFinder’s Innovative AI Helps Banks Seamlessly Comply with CRA Final Rule Changes Coming in 2026

Discover how PathFinder gives banks credit for 7 CRA-qualifying activities, using cutting-edge technology to stay ahead of regulatory changes and support underserved communities more effectively.

Growth Plan

$999/mo

Ideal for small teams looking to automate conversion processes with AI-driven insights.

-

AI-Powered Funnel Analysis (automated insights into drop-offs & opportunities)

-

Automated Lead Scoring & Prioritization

-

Real-Time Buying Signal Tracking

-

Smart Workflows for Engagement Optimization

-

Access to Core Integrations

-

2 User Seats

-

Add-on: Professional Services available for additional support

Scale Plan

$1,999/mo

Best for growing teams that need automation + expert guidance to refine conversion workflows.

-

Everything in Growth Plan +

-

Advanced AI Experimentation & A/B Testing Recommendations

-

Predictive Conversion Modeling

-

Multi-Touch Attribution & Journey Insights

-

3 User Seats

-

Priority Ticketed Support

-

Professional Services Bundle (Up to 5 hours/month of expert support on setup, strategy, and optimizations)

Custom Pricing

Contact Us

For organizations that want to fully automate conversion optimization with ongoing CRO expert support

-

Everything in Scale Plan +

-

AI-Driven Funnel Optimization Playbooks

-

Custom AI Models for Industry-Specific Conversions

-

Custom AI Models for Industry-Specific Conversions

-

Dedicated Onboarding & Support Team

-

Custom Integrations & API Access

-

10 User Seats

-

Professional Services Bundle (20+ hours/month of hands-on conversion rate optimization consulting, experiment management, and automation setup)

-

CRA Qualifying Marketing Activities and Eligibility Scans

-

Cross-Sell Other Community Lending Loan Products

-

Down Payment Assistance Eligibility Scans

-

Majority-Minority Census Tract Eligibility Scans

Nonprofit credit counseling and education services are offered at a separate fee.